Nuclear Power Renaissance

The four nuclear power revitalization focused executive orders signed by white house on May 23-24, 2025, bring about a renewed interest in the small module reactor space (SMRs). If things go according to their plan these orders, coupled with industry advancements, could result in a potentially rapid nuclear renaissance driven by small modular reactors (SMRs). Here’s why this matters for civilian energy and what’s on the horizon:

$10k to Start a Manufacturing Business?

Forget manufacturing in China and spending millions to set up a plant. What if i told you, you could set up a manufacturing business for $10k. Here’s an industry that is now set to grow in dimensions we don’t fully understand. Additive Manufacturing.

Problems: We all have them, now what?

Lets face it, we all have problems and the number of them grow over time. Health problems, family problems, problems in business or your career. The focus of this post is really about professional problems, but for the others, my opinion is that they are typically symptoms of something broken in system. If you can […]

Four reasons why I turned down the chance to bid in the FTX bankruptcy auction at a 50% discount.

And why i think you should’ve done the same Yesterday I was invited to participate in the liquidation of assets from bankrupt crypto lender FTX, along with a group of other accredited investors. Winners of the last auction won Solana SOL tokens at roughly half the current market price. Is this a no brainer deal? […]

Inflation in a US millennials lifetime (an independant review)

Inflation is defined as the decline in purchasing power of a given currency in time. Typically this is measured by measuring changes in a spread of the price of a basket of goods and services – things like oil, corn, etc. But this is an independent review, so let’s see if we can look at […]

US Sectors: Charts

When people buy the S&P 500, they buy the 500 largest US firms in ratio to their market cap. These firms spread across industries, and so the exposure of one’s portfolio to the various sectors depends not on the importance of a particular sector in the GDP, or its need in the current economy – […]

Charts: Crypto

A few helpful charts when looking at investments in crypto. These will help guide you when you think about where to put your money in today.

Charts: US Equities

A historical look back at the comparison of the S&P500 with various ETFs in order to offer context to investments today.

AI Trading program placed #18 nationally (25.87% return in 4 weeks)

A few weeks ago, I wrote about a tool I created to keep a “peripheral eye” on the stock market, with plans to plug it into on online brokerage that could make trades automatically (without any involvement from me). This post seeks to share the results from that endeavor. Between October 26 – Nov 20 […]

Decentralized Finance – a house of cards (for now)

Im writing this article to spread awareness on the underpriced risk associated with the Decentralized Finance marketplace of today. The decentralized finance system is a house of cards built upon one fundamental assumption – the base crypto asset, or the crypto market, will not crash. There has been a recent breakout of DeFi apps, and […]

Developing a peripheral eye for the stock market

I’ve always been passionate about investing in the stock market – one of the reasons I did a concentration in Finance, while attending the University of Chicago for my MBA, was to learn more about investments, asset pricing, and corporate finance – and to be able to understand articles off the Financial Times (ha!). But […]

Effect of “NY on Pause” on Manhattan Condo prices

A deep dive into what happened to condo prices in the different neighborhoods in Manhattan when NYC was hit by record COVID cases in March 2020, and was placed “on pause”.

Recent Posts

Nuclear Power Renaissance

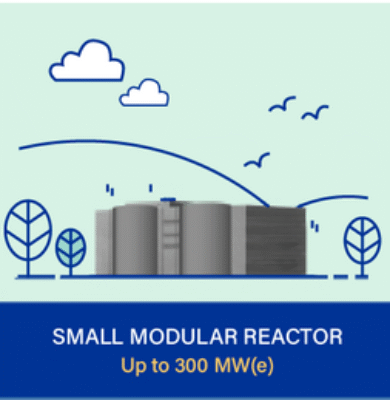

Small Module Nuclear Renaissance by 2028? How the recent white house executive orders could impact this space

The four nuclear power revitalization focused executive orders signed by white house on May 23-24, 2025, bring about a renewed interest in the small module reactor space (SMRs). If things go according to their plan these orders, coupled with industry advancements, could result in a potentially rapid nuclear renaissance driven by small modular reactors (SMRs). Here’s why this matters for civilian energy and what’s on the horizon:

SMRs in Civilian Applications by 2028:

The orders mandate an 18-month licensing process for new reactors and streamlined approvals for standardized SMR designs. SMRs are build modularly and offsite expediting build time to ~3 years. SMRs like NuScale’s 77 Mwe’s design is already NRC-certified and a larger GE Vernova’s BWRX-300 is advancing in Canada. We could see civilian SMR deployments powering communities as early as 2028. Interestingly, the DOE’s pilot program targets three operational reactors by July 2026, further accelerating this timeline.

Low power costs and energy decentralization:

SMRs bring power generation efficiency down to near large reactor levels. Civilian enterprises have customarily depended on oligarchic utility companies for their energy needs. Alternatives have been solar which has also necessitated battery technology – which is expensive, and difficult to scale. Theoretically, less regulation and available SMR tech would empower commercial enterprises to generate power on site, enabling new industries.

Economic and Strategic Impact:

The orders bolster domestic uranium supply chains, with a 120-day plan to expand HALEU production, reducing reliance on foreign sources like Russia. This supports civilian projects while creating jobs through workforce programs prioritized by September 20, 2025. SMRs’ factory-built designs promise cost reductions—potentially to $4,500/kW in the U.S. by 2040—making them competitive with fossil fuels.

___

Challenges remain, including public perception and supply chain scaling. Yet, with global nuclear capacity projected to grow 3% annually through 2026 and SMRs leading the charge, the U.S. is poised to reclaim energy leadership. I’m excited to guide this transition, ensuring communities and industries thrive in a clean energy future.

#NuclearEnergy #SMRs #EnergyInnovation

$10k to Start a Manufacturing Business?

Forget manufacturing in China and spending millions to set up a plant. What if i told you, you could set up a manufacturing business for $10k. Here’s an industry that is now set to grow in dimensions we don’t fully understand. Additive Manufacturing. What’s Additive Manufacturing? It’s 3D printing. It’s called that because it’s different from subtractive method of production – which removes unnecessary materials from the final material.

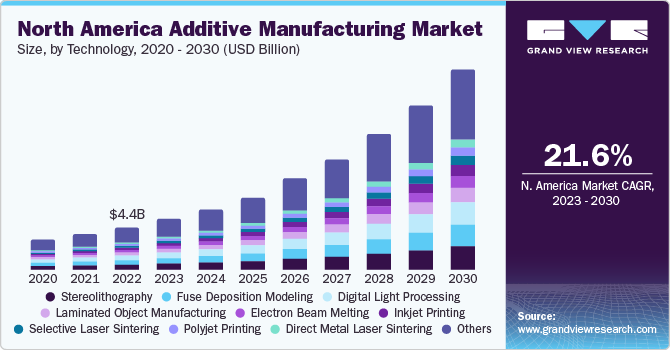

The technology for 3D printing has existed for many years now, but what makes this moment special is that it has advanced enough where it is price competitive to larger manufacturing players in several categories already. In fact, according to research from grand view research below, it is already a 5 to $10 billion USD market, and set to grow at a very healthy CAGR of 21% for the rest of the decade – creating opportunities in many interesting ways.

One of the first successful applications was in the dental clinic. Patients who needed a dental implant or crown – Instead of waiting for a week, could now have one during a single doctors visit. This was a game changer in terms of patient experience.

Perhaps you know someone who has had Invisalign? That’s another medical procedure enabled through the use of accessible 3D printing. Retainers are produced for only a few dollars each, and sold at a roughly 95% gross margin.

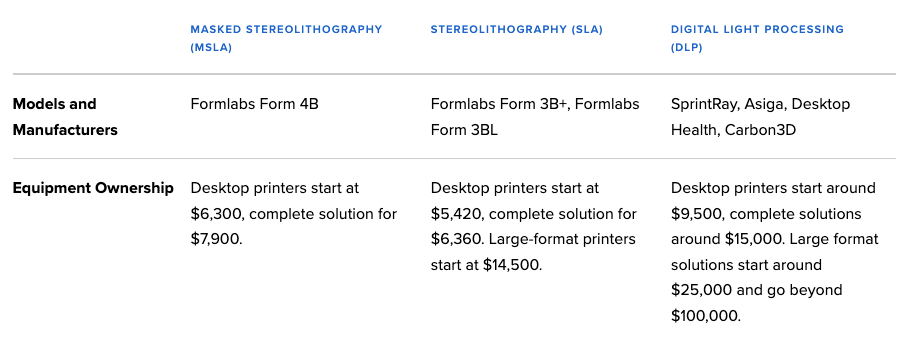

There are several existing and to be developed niche applications to 3D printing – from construction to jetfuel (yes fuel for fighter planes!) so the sky is literally the limit. Barriers to entry are relatively low with potential first mover advantages in several new categories. The person who develops the channels first, will have distinct advantages over future challengers. Here are some sample prices of 3D printers used for medical (dental) applications – TLDR, it’s not a whole lot.