Decentralized Finance – a house of cards (for now)

Im writing this article to spread awareness on the underpriced risk associated with the Decentralized Finance marketplace of today.

The decentralized finance system is a house of cards built upon one fundamental assumption – the base crypto asset, or the crypto market, will not crash.

There has been a recent breakout of DeFi apps, and with Coinbase announcing its integration a few months ago, it has grown to prominence even more. Decentralized finance works via unregulated smart contracts, processed by nodes (computers) spread across the world that immediately enforce the loan contracts upon specific events. One particularly powerful network might be the Etherium (ETH) network for example. It runs on over 8000 nodes and is the largest network (excluding Bitcoin). For the simplicity of this article, let’s limit this article to the ETH network only, as insights may be extrapolated (and magnified) from here unto smaller networks.

Technically 60% of the network runs on the cloud (and 25% on AWS) but for the purposes of this article, we will be ignoring a systemic risks of corporate boycott – or regulatory restriction that could bring down a large majority of the network. Instead, let’s limit our arguments to economic fundamentals – and banking 101.

Scenario 1: The Borrower

We start with the story of Sam – an American everyday man. Sam heard about ETH and bought 20 ETH with $5,000 of savings a year ago (when the price was $250). The coins have doubled in value since then and he is now sitting with an on paper value of $10,000 worth of ETH. Sam is happy with his investment.

Recently, Sam’s wife asked for a kitchen remodel which costs $2,500, and in order to fund the project, he collateralizes his 20 ETH in exchange for $2,500 USD and a 2% interest rate (1:4 represents an extremely conservative debt to collateral ratio, and is used by Celsius). Despite the high collateral, this loan is easy to originate – requires no credit check, and the interest rate is great. In fact, Sam thinks to himself that his ETH will probably appreciate even more than 2% over the term of the loan – so he goes for it.

Unfortunately, the timing isn’t great for Sam. The price of ETH crashes for reasons not emphasized in this article* from $500 when Sam initiated his loan to $125, which causes Sam’s loan to automatically terminate, as the smart contract automatically kicks in, liquidating all of his collateral of 20 ETH to cover this loaned amount. When the dust settles, Sam has the $2500 of cash from the loan in hand, but nothing else to show. Sam is no longer happy, as he did not want to sell his ETH, which would probably have bounced back next month.

* Potential reasons include an economic event or news story that spreads a message eroding trust, or a market correction. Perhaps i’ll go into this in greater detail in a subsequent post.

This is not what we expect from the banks we have created. A loan from a bank would not be automatically terminated during a healthy repayment. While it may seem unlikely to encounter such a large drop in value, todays crypto lenders actively sell the collateral at several price points to ensure they are holding a fixed ratio of collateral to loaned amount. So liquidation can be triggered as early as a 5% drop in value.

The only way I can think of to protect against this scenario is the convert to ETH into a USD-stablecoin, prior to payout in fiat currency so that the collateral is stable to volatility. But a deeper dive shows that this does not work any better for a consumer than selling a portion of ETH for USD to buy back into ETH later.

Scenario 2: The Lender

Zack went through the same market cycle Sam did, but differently. Zack is a crypto Enthusiast, and a HODLer (plans to hold his crypto until the end of time) and is sitting on a wallet of 100 ETH. He read somewhere that it’s smarter to earn interest on his assets instead of leaving them in cold storage, he participates in DeFi (Decentralized Finance) platforms earning 5% interest. In order to earn interest rates at that level, all of his ETH is converted to fiat currency and lent out on a more aggressive market which allow borrowing up to 60% of collateral.

When a big price drop begins, the people Zack have loaned money to stop making payments because their borrowed cash amount is worth more than the value of their ETH they have as collateral. They also haven’t signed any legal documents holding them personally liable, and there’s no regulatory body that can make them. As the borrowers collateral is liquidated at lower value in order to pay back Zack, when the dust settles, Zack’s loaned ETH tokens are returned with diminished value. He has now lost a portion of wealth.

What’s scary about this situation is that willing default could start as early as a price drop of 40% of the underlying crypto asset’s value from the time the loan was originated. One has only to look to the housing market to see how it plays out – when mortgages outweigh the price of the house – people stop paying. This happened despite the hurdles of litigations, long lasting impact on credit scores, eviction and so on.

Likelihood:

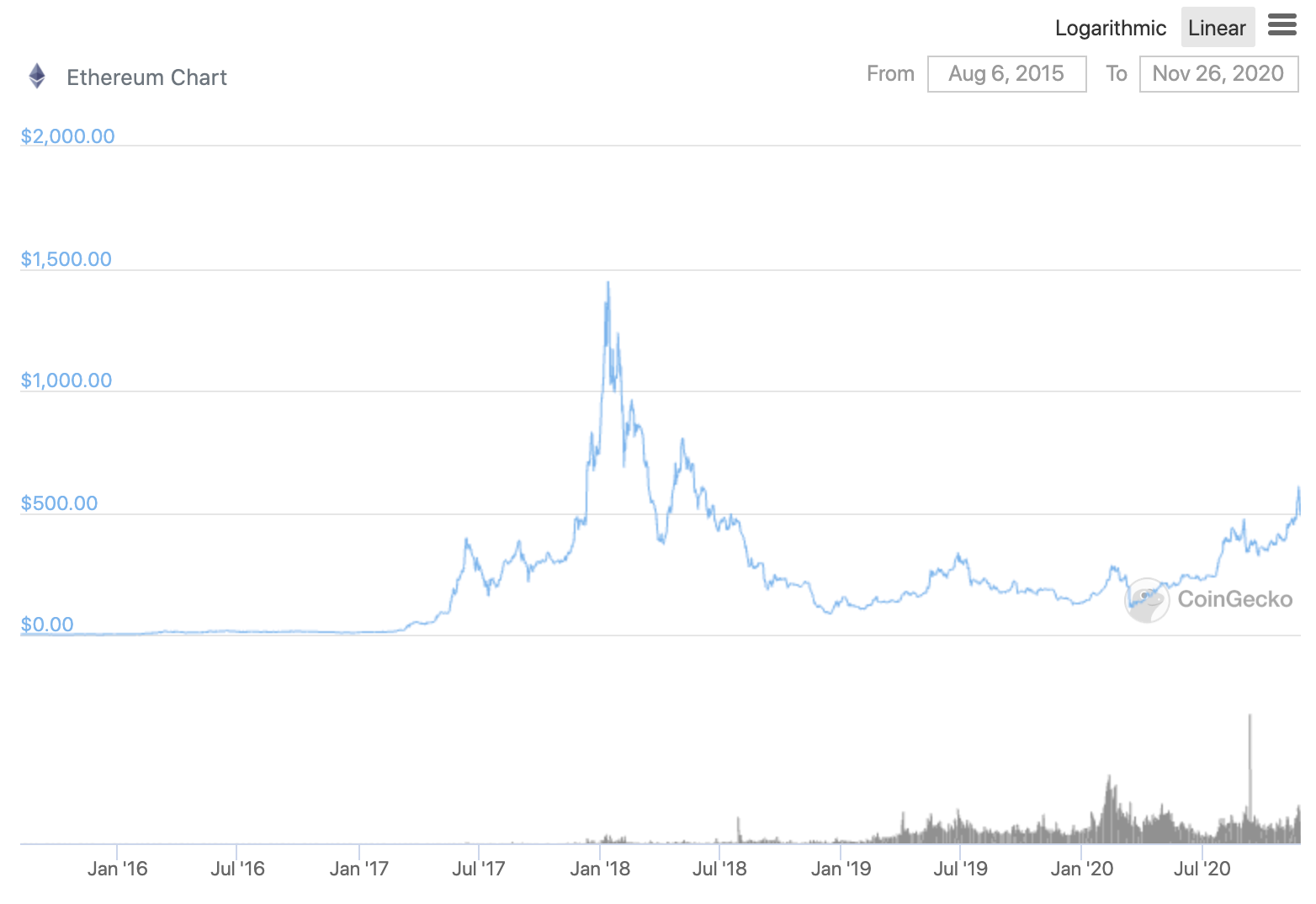

What are the chances that one of the two situations above or something like it might happen? Too high for comfort in my opinion. There are always people eager to exchange higher risk for a higher interest rate. But in my opinion, this risk is undervalued – as the average person believes these outlying conditions will not happen. These people might get burned, and spreading awareness of the commonality risks is why I’m writing this article. In the charts below, if you you visually scan the all-time ETH price chart, you can quickly visually see that this has happened at least a dozen times in the past.

While this article has limited its focus to ETH for simplicity, it is safe to say that these market effects would likely be magnified in smaller markets due to fewer participants and less liquidity at a particular price. Increasing the risks even more.

FYI, this is the state of the market today as I write this. Count the number of crypto assets that lost 15-30% of their value in the last 24 hours. What do you think happened to the borrowers and sellers in these markets? Which direction do you think the automatic selloffs from smart contracts liquidating crypto collaterals pushed the prices?

Most interestingly, nothing special happened recently. I assume some people wanted to cash out their earnings before Thanksgiving weekend – and the result was a massive market tumble. Here’s a closer look at what happened to XRP, the #3 market cap crypto behind BTC and ETH. It dropped 34%.

Do you see the house of cards now?

Please feel free to leave your thoughts and comments. Thank you for your time reading this, and hope it helped you.