Effect of “NY on Pause” on Manhattan Condo prices

With the 30-year fixed mortgages under 3%, there’s been a lot of buzz recently about the pandemic potentially being good time to buy real estate at discount. In fact, this article from the WSJ reported an increase in house sale prices.

Meanwhile, this article talked about the drop in the housing prices in San Francisco due to a migrating tech force.

I was curious to see how my current home town of Manhattan responded to these uncertain times. Hopefully the information below helps add perspective to others who are curious about NYC’s real estate.

First, a note on my process: I pulled recent sales from the NY DOB, and shortlisted to residential condo that saled between $200k — $10M. Why not co-ops? Because there are too many variables like HDFC and community coops that might shew the data. Admittedly, I was also personally more interested in a condo.

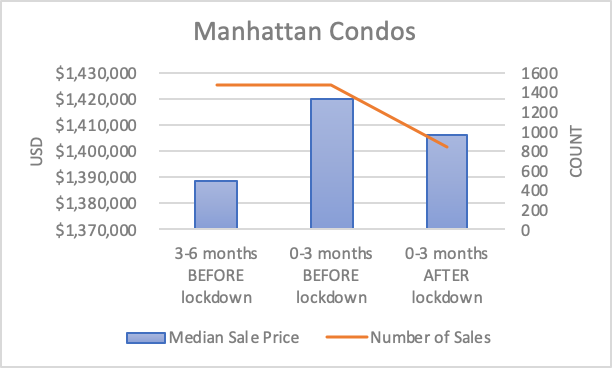

Anyway, next step was to break the sales records data into two primary time series — 3-months before March 22, and 3-months after. The final steps were to use Python, and some manual data cleanup, to come up with the results below.

Despite a marginal decline in median price, there was a noteworth drop of 42% in number of condos sold.

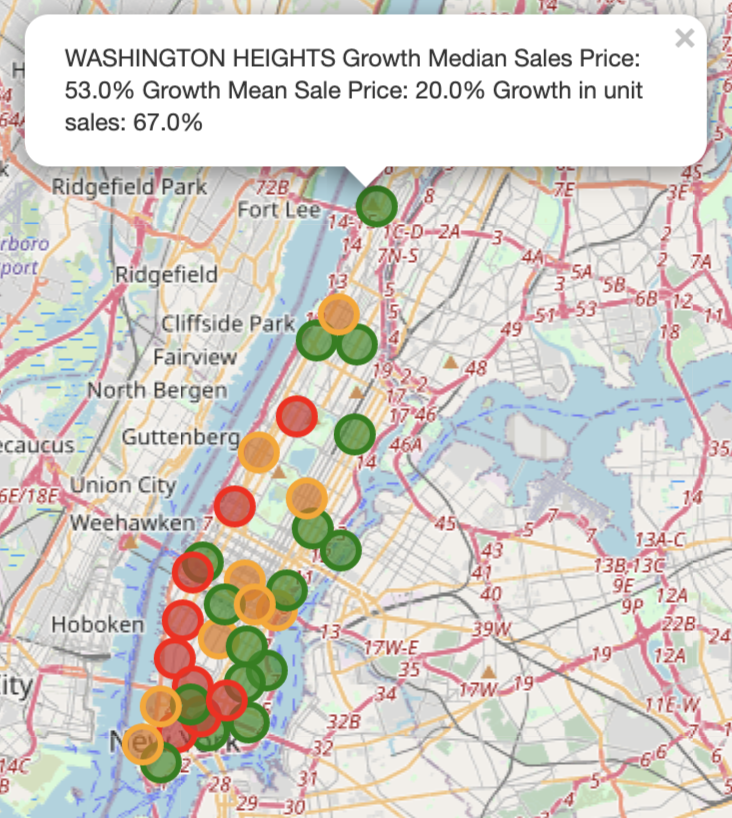

But I wanted to dig deeper as there are always winners and losers in any economy, and when going down to the neighborhood level, I actually found that some neighborhoods performed better than others. Interestingly, the East facing neighborhoods seems to have performed the best — boasting significant growth in median sales price as well as number of sales in some circumstances, while the west facing onces felt the biggest losses.

You can use the interactive map below to look up each neighborhood yourself.

See the Pen

Manhattan Map- Condo Prices by Karm C (@karmcy)

on CodePen.

And if for any reason the map above doesn’t work, here’s a screenshot of the result. Red circles indicate a drop in sales price, green a rise, and orange is somewhere in between.

I hope this helps you with your own decision-making strategy. You could always look deeper into correlation of median income or building age, but my goal was an over all look. As always, thoughts and ideas are interesting and welcomed. Thanks for your time!