Four reasons why I turned down the chance to bid in the FTX bankruptcy auction at a 50% discount.

And why i think you should've done the same

Yesterday I was invited to participate in the liquidation of assets from bankrupt crypto lender FTX, along with a group of other accredited investors. Winners of the last auction won Solana SOL tokens at roughly half the current market price. Is this a no brainer deal? Here are 4 reasons why I said no and why I would not suggest you invest $100k in this deal either.

1. Liquidity (Lack Off)

FTX received it’s tokens from Solana for pennies, with the contingency that they remain locked on an unlocked schedule until Jan 2028. Despite acquiring SOL tokens 50% discount, part of the deal is that the assets acquired would be unlocked at the same pace: 1.75% every month, with a cliff unlock of 23% in March 2025. On the positive, all locked SOL are staked at ~7% APR, and all staked yields are completely liquid.

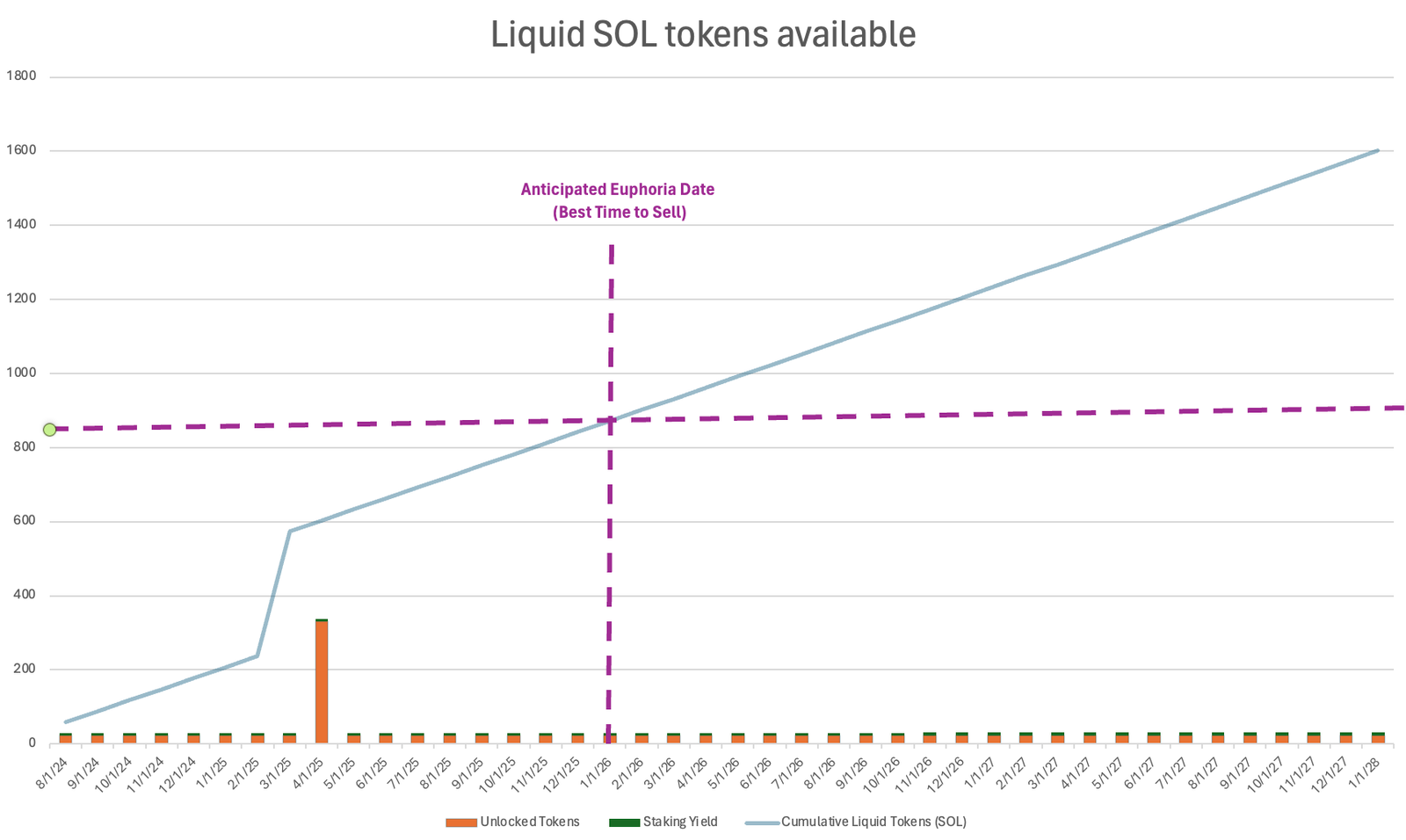

Crunching the numbers, $100K invested at a discount of 45% of current price of $136 would buy 1337 locked SOL tokens at an average price of $74.5. By end of 2025 (20 months), you would have access to 841 SOL (accounting for fees, staking yield, unlock schedule etc). 584 SOL would remain locked (43.6% of the original purchase) for the next several years.

2. High Volatility makes it worth it to buy more expensive SOL in the open market

This is where a lot of sentiments can probably chime in. These are highly volatile assets. Buying the VOO index fund for half the current market value and locking it for 4 years, would’ve been a completely different decision. Crypto assets can fluctuate by 10% a day at times. I can’t imagine how much pain I would feel if the market hit Euphoria and I couldn’t sell.

In fact, I did a second calculation where I compared what the math would look like if the market price dropped only 15% to $115 and I invested the same $100k in a direct purchase in the market and staked everything. (Note: the price of SOL did actually drop to $115 two weeks ago, so this isn’t all that farfetched).

The result? $100k buys you 870 SOL tokens, and by the end of 2025, you’d have a total of 951 SOL (adding staking yield). This is 110 more liquid tokens than you’d have access to than buying at auction.

The reason I compare both situations to the end of 2025 is because many analysts believe this is the time when previous crypto cycles have peaked. Question for you: Would the extra 110 SOL sold at the market peak be worth more than the 584 SOL locked up and earning yield? With a 97% decline in SOL’s price last cycle from peak to bottom, I think there’s a case to be made that it would be.

3. Opportunity Cost

I’ve had assets locked up for 3 years before. It isn’t fun. Liquidity lets you to stay nimble and take advantage of opportunities. Locking your funds for 4 years is a mostly irreversible move. I tend to believe that tight monetary policy continues to apply pressure on the business cycle. My personality prefers to remain flexible and take advantage of opportunities as they come.

4. If it seems too good to be true, it likely is.

This one is more superstitious than anything else. But if opportunities to bid on major assets are presented to puny investors like me. To me, this means the hedge funds have passed them down. This is presented as an opportunity to buy something at 50% off, but its not. It’s really a bad opportunity, and those with access to billions know it.

Again, I could be wrong and this may turn out to be an amazing deal. I mean, imagine buying bitcoin at half the market price and it being forcibly locked up for 4 years. ($$$!)

Time will tell. You’re welcomed to disagree with me, and if you are an accredited investor and would like to participate in the auction yourself, do not hesitate to reach out and I’ll connect you with the VC firm investing in this.