Developing a peripheral eye for the stock market

I’ve always been passionate about investing in the stock market – one of the reasons I did a concentration in Finance, while attending the University of Chicago for my MBA, was to learn more about investments, asset pricing, and corporate finance – and to be able to understand articles off the Financial Times (ha!). But as time passed, and I was traveling or working really hard – I’d often lose sight of the stocks I was following, and at times even lose track of stocks I was personally invested in – missing obvious exit signals, and at times losing 66% of value, when I should have only lost 10%.

In order to avoid such novice mistakes, and to make the landscape of the US stock market easier to navigate, I decided to put some of my own thinking criteria into a Data Analytical program to create a daily watchlist of symbols (works between 8am EST- 4pEST) .

The article below gives you an overview of the product and goes into fundamentals of the process involved behind the scenes. Please bear in mind that at the time of publishing, this program works only with simple US Equity symbols – not options, futures, commodities, crypto or forex – all of which are also great. In case you’d like to skip the background and rush to the finished product, click here.

Factors Used:

Volume:

1. It’s all about volume. Anything trading above 1.5x the average daily trading volume has my attention and is marked with “Investigate” along with a gray background color. Anything traded near the usual daily volume – I assume is being traded by the computers in JP Morgan’s office, and that is something that I don’t care to compete against. However, when volume goes high, it signals JP Morgans computer battling Goldman Sachs, or a variety of Retail investors buying or selling due to greed or fear. This is a landscape, I’m more likely to join.

along with a gray background color. Anything traded near the usual daily volume – I assume is being traded by the computers in JP Morgan’s office, and that is something that I don’t care to compete against. However, when volume goes high, it signals JP Morgans computer battling Goldman Sachs, or a variety of Retail investors buying or selling due to greed or fear. This is a landscape, I’m more likely to join.

Price Action for Swing Trading

You cant hit the ball, unless you… Swing. Corny jokes aside, I like swing trading for reliable stocks because I believe what goes down comes back up (and vice versa). Personally, I frown upon long term shorts because of interest payments which add to my risk- therefore, my personal Swing Trading strategy is limited to buying at discount.

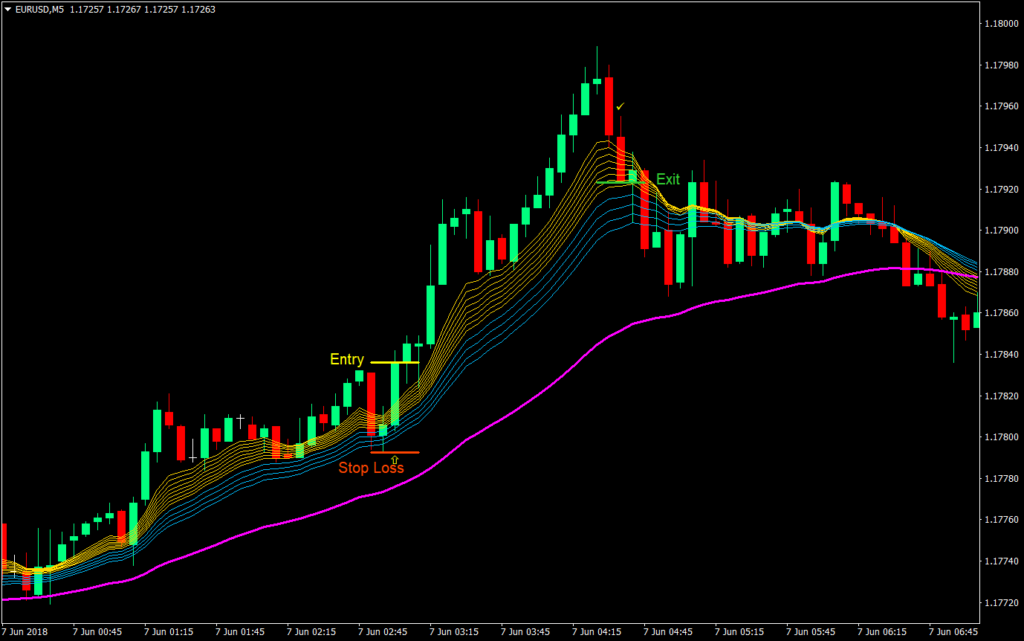

After collecting daily price data for the last 2 weeks, along with a historical oversight , I have some idea of where this stock has been – at least recently. Then, I’m constantly monitoring the market in 5min bars – to look at changes within those periods of time, but also overall during the day. When we observe the stock has fallen below a certain threshold – say 2-5% lower than the 14day close price, we will add this stock to the Watchlist with a “swing” strategy and a blue color.

Note: All the drops and gains are adjusted by the current state of the market. So, for example, if the market is down 10% today, and this stock is also down 10%, it will not catch my eye. However, if the market is up, say 5%, but this stock has still fallen, I’m interest at looking at it some more.

Finally, each symbol added to the Watchlist, is then compared with a list of similar companies within its industry – in order to generate an aggregate comparison with them. For example, if the entire oil industry is down 10% today, and this stock is also down 10%, we now have an understanding of why. If however, the sector remains the same – we should look at this some more.

3. Price Action for Daytrading

Is today a good day to daytrade? I’m not a day trader by any means but since I was writing a program that got close to some of insights day traders used, I figured it would make sense to add it to the watchlist.

Most of the stocks to daytrade show up prior to market open, although some do pop up mid day as well – depending on the overall volume and price action. The process to isolate these stocks is inspired (okay, “imitated”) from Andrew Aziz. It goes like this. If we find a stock that has gapped at least 2% pre market (up or down), since yesterdays close, and traded with sufficient volume (over 50000 shares pre market) – we are interested. We however, only trade medium or high float stocks (ideally medium) which have an average true range of $0.50 a day. If something is able to match all of this, we then added to the watchlist with a “daytrade” strategy and an Orange color.

You will notice that There are a few other factors listed as well, including the SMA50, SMA 200 and the number of 5m consecutive candlesticks (positive numbers indicate White candlesticks, negative numbers indicate Red candlesticks. Any 5 minute bar with an open and close price between $0.02 of each other is considered a “Doji” and will show up as 0)

My goal is to build intelligence upon this – perhaps by creating a subsequent watch list that takes the data here and looks at it on the minute level, running a variety of technical analysis tools and potentially day trading itself – but for now, I believe this list holds value to anyone who reads. I know it would to me.

*I’m also not looking to compete against the High Frequency Trading systems out there, so it would have to work in very specific situations only.

If you have any suggestions for improvement, please do not hesitate to let me know. As always, thanks for your time and good luck out there.